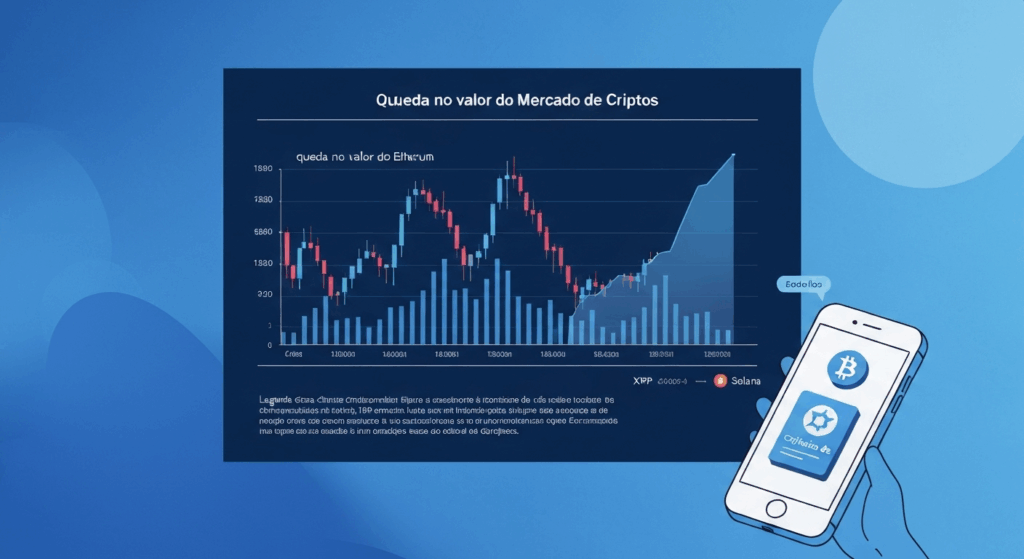

The cryptocurrency landscape is constantly evolving, and last week brought a significant movement that caught the attention of analysts and the global community. Recent reports indicate that institutional investors are adjusting their portfolios, moving capital from established crypto assets like Bitcoin (BTC) and Ethereum (ETH) to promising altcoins such as XRP and Solana (SOL). This strategic realignment may signal a new phase in the digital asset market.

The Reconfiguration of the Institutional Investment Landscape

Data from a CoinShares report revealed that Bitcoin and Ethereum funds recorded substantial net outflows last week, totaling $719 million for BTC and $409.4 million for ETH. In contrast, XRP and Solana stood out, attracting positive net inflows of $93.1 million and $291 million, respectively, during the same period. This capital movement suggests growing confidence and interest in altcoins with clear growth catalysts.

The Domino Effect of ETFs: The Rise of XRP and Solana

The main driver behind this institutional enthusiasm seems to be the expectation of approval for spot price Exchange Traded Funds (ETFs) for XRP and Solana in the United States. Influential analysts like Eric Balchunas from Bloomberg estimate a 100% chance of approval for these funds, given compliance with the generic listing standards recently approved by the SEC.

For XRP, this would be a spectacular victory after years of legal battles. The cryptocurrency, which has already gone from the SEC lawsuit to institutional favoritism, is now on the brink of recognition that could solidify its position in mainstream finance. Approval of an XRP ETF is seen as a game changer, opening doors for even greater adoption by major players.

Solana, in turn, has benefited from its high-performance blockchain technology and expanding ecosystem. The final deadlines for the Solana ETFs are approaching (October 10), preceding those for XRP (October 17), which could make SOL the first to get the green light. Experts like Nate Geraci, analyst at ETF Store, believe that demand for these ETFs is underestimated, forecasting a significant positive impact on SOL and XRP prices, similar to gains observed in Bitcoin and Ethereum after the launch of their respective ETFs.

What Drives the Shift and Future Implications

The capital rotation from Bitcoin and Ethereum to XRP and Solana is not just diversification but a pursuit of new horizons for appreciation. Institutional investors, who have historically bet heavily on BTC, as seen in MicroStrategy doubling its Bitcoin bet with Wall Street support, now see altcoins with strong regulatory growth potential as the next big opportunities.

However, the path is not without obstacles. The possibility of a U.S. government shutdown raises concerns about potential delays in ETF approvals. James Seyffart, also a Bloomberg analyst, has already warned about how such an event could complicate the approval process. The impact of such delays on market sentiment and fund flows is a variable to be monitored.

This movement underlines the growing maturity of the crypto asset market, where investors actively seek the next wave of value. The era in which Bitcoin alone dominated as the sole institutional safe haven is gradually giving way to a more diversified portfolio, driven by technological innovations and regulatory clarity. Although bold predictions like Bitcoin at $1 million continue to circulate, Wall Street’s attention now turns to where the next big leap may occur.

Conclusion

The decision by institutional investors to reallocate capital from Bitcoin and Ethereum to XRP and Solana is a testament to the ever-changing dynamics of the cryptocurrency market. Driven by the imminent approval of ETFs and growing regulatory recognition, this trend not only validates the potential of these altcoins but also highlights the ongoing pursuit of innovation and returns in the digital asset space. The future of the crypto market promises to be as fascinating as it is volatile, with new players and strategies reshaping the landscape every day.